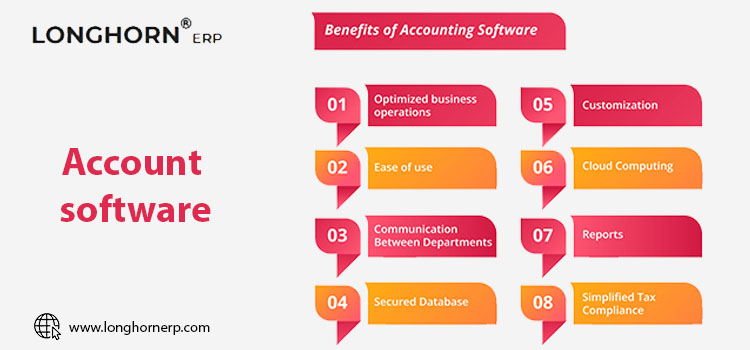

In the ever-evolving landscape of financial management, businesses today face the dual challenge of efficiency and accuracy. Enter accounting software, a revolutionary tool that has transformed the way organizations handle their finances. From startups to multinational corporations, the benefits of using accounting software are manifold, offering a streamlined approach to financial tasks that were once laborious and error-prone.

1. Automation for Efficiency

Gone are the days of manual data entry and paper-based ledgers. Accounting software automates repetitive tasks such as invoicing, bill payments, and reconciliation. This automation not only saves time but also reduces the risk of human error. By streamlining these processes, businesses can reallocate resources to more strategic activities, driving growth and innovation.

2. Real-Time Insights

One of the most significant advantages of accounting software is the ability to access real-time financial data. With just a few clicks, businesses can generate up-to-the-minute reports on cash flow, profit and loss, and balance sheets. This instant access to key metrics empowers decision-makers to make informed choices promptly. Whether it’s identifying areas of overspending or forecasting future financial trends, real-time insights are invaluable in today’s fast-paced business environment.

3. Enhanced Security

Security is a top priority for any organization handling financial data. Accounting software offers robust security features such as data encryption, regular backups, and user permissions. These measures ensure that sensitive information remains protected from unauthorized access or cyber threats. Additionally, cloud-based accounting solutions provide the added benefit of data accessibility from anywhere, at any time, without compromising security.

4. Scalability and Customization

As businesses grow, so do their accounting needs. Accounting software is designed to scale alongside the organization, accommodating increased transaction volumes, additional users, and expanded reporting requirements. Furthermore, most software platforms offer customization options, allowing businesses to tailor the system to their specific needs. Whether it’s integrating with other business tools or creating custom financial reports, this flexibility ensures that the software evolves with the organization.

5. Compliance and Reporting

Staying compliant with ever-changing financial regulations can be a daunting task. Accounting software simplifies this process by automatically updating tax rates, calculating deductions, and generating reports that adhere to regulatory standards. Whether it’s tax filings, audit trails, or financial statements, businesses can ensure accuracy and compliance with ease.

6. Improved Collaboration

Collaboration among teams is essential for effective financial management. Accounting software enables seamless collaboration by allowing multiple users to access the system simultaneously. Whether it’s the finance team working on budgets or the sales team tracking invoices, everyone can stay connected and updated in real time. This transparency fosters better communication and alignment across departments, leading to improved efficiency and teamwork.

Conclusion

In conclusion, accounting software has revolutionized the way businesses manage their finances. From automation and real-time insights to enhanced security and scalability, the benefits are undeniable. By embracing this technology, organizations can streamline their financial operations, reduce errors, stay compliant, and pave the way for future growth. In today’s competitive landscape, accounting software isn’t just a tool—it’s a strategic asset that empowers businesses to thrive.

So, whether you’re a small startup looking to simplify bookkeeping or a multinational corporation aiming for greater financial visibility,

is the cornerstone of modern financial management. Embrace the future of finance, and watch your business soar to new heights of success.